Jeremy Micah Siegel

age ~55

from Colorado Springs, CO

- Also known as:

-

- Jeremy M Siegel

- Jeremy N Siegel

- Joyce W Siegel

- Jeremy M Siegal

- Jeremy M Sieler

- Jermey Siegel

- Jerry Siegel

- Nancy Siegel

- Phone and address:

-

415 Paisley Dr, Colorado Springs, CO 80906

7195763195

Jeremy Siegel Phones & Addresses

- 415 Paisley Dr, Colorado Spgs, CO 80906 • 7195763195

- Colorado Springs, CO

- 106 Rachael Ln, Warner Robins, GA 31088 • 4789880464

- El Paso, TX

- 19000 Trail Bay Dr, Eagle River, AK 99577

- Davis Monthan AFB, AZ

- Columbus, MS

- Del Rio, TX

- Anchorage, AK

- 415 Paisley Dr, Colorado Springs, CO 80906 • 9076464280

Work

-

Position:Food Preparation and Serving Related Occupations

Education

-

Degree:High school graduate or higher

Emails

Isbn (Books And Publications)

Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies

view sourceAuthor

Jeremy J. Siegel

ISBN #

0071494707

Revolution on Wall Street: The Rise and Decline of the New York Stock Exchange

view sourceAuthor

Jeremy J. Siegel

ISBN #

0393035263

Managing the Market: Long-Term Investment Strategies in the Post-Bubble Economy

view sourceAuthor

Jeremy Siegel

ISBN #

0743229088

Resumes

Jeremy Siegel

view source

Jeremy Siegel

view sourceLicense Records

Jeremy J Siegel

License #:

RS135476A - Expired

Category:

Real Estate Commission

Type:

Real Estate Salesperson-Standard

Jeremy Micah Siegel

Address:

415 Paisley Dr, Colorado Springs, CO 80906

License #:

A3973618

Category:

Airmen

Googleplus

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

Jeremy Siegel

News

5 key lessons for investors after this week's wild stock market ride

view source- 1 is I would tell you to turn off the TV so you don't get Jeremy Siegel screaming on CNBC that we need 150 basis points of emergency cuts," McGrath said, referring to the Wharton economist's call earlier this week for the Fed to execute an emergency intra-meeting rate cut followingf the market rout

- Date: Aug 09, 2024

- Category: Business

- Source: Google

Nasdaq, S&P 500 Set For Negative Start: What's Driving Futures Lower - Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), SPDR S&P 500 (ARCA:SPY)

view source- Delving into the near to mid-term catalysts, Wharton professor and Senior Economist to WisdomTree Jeremy Siegel said all eyes are on the Feds upcoming meetings and subsequent economic data releases. He sees the probability of the first Fed rate cut in the current monetary policy cycle to come in Se

- Date: Jul 02, 2024

- Category: Business

- Source: Google

WBUR host Rupa Shenoy to leave Morning Edition

view source- Shortly after Shenoy joined WBUR, rival GBH shook up its own version of Morning Edition by bringing on two new local co-hosts, Paris Alston (formerly of WBUR) and Jeremy Siegel, starting in February 2022.

- Date: May 13, 2024

- Category: Your local news

- Source: Google

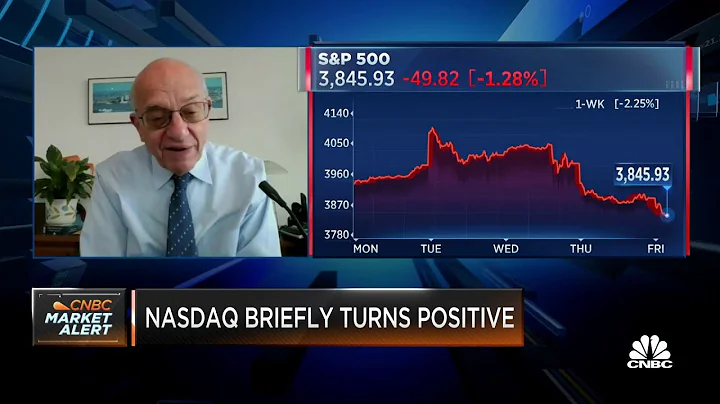

Nasdaq, S&P 500 Futures Jump As Wall Street Eagerly Awaits Tesla's Q4 Earnings: Analyst Says Rally Broadening But Favors These Stocks - Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), SPDR S&P 500 (ARCA:SPY)

view source- The Fed rate moves may not be in isolation, according to Wharton professor Jeremy Siegel. If the economy is strong and the Fed does not cut rates as much as some expect earnings growth may end up being supportive for the market, the economist said in his weekly commentary for WisdomTree.

- Date: Jan 24, 2024

- Category: Business

- Source: Google

US Stock Futures Slide As Traders Look Past Positive Earnings News Flow; Analysts Predict Year-End Rally

view source- Stocks are poised for a year-end rally and a good 2024, said Wharton professor and noted economist Jeremy Siegel in his weekly WisdomTree commentary. He noted that earnings reports that have begun to trickle in have largely been solid, with no material signs of earnings downgrades.

- Date: Oct 17, 2023

- Category: Business

- Source: Google

The Fed won't pivot from rate hikes until end of 2023: JPM strategist

view source- causing a recession. Despite inflation clocking in above expectations in September, Wharton professor Jeremy Siegel noted that inflation was likely being overstated in the official statistics, and some sectors of the economy, like housing, have been deteriorating in response to rising interest rates.

- Date: Oct 28, 2022

- Category: Business

- Source: Google

Stock market outlook: Wall Street torn on next 20% direction in equities

view source- Wharton professor Jeremy Siegel is a long-time market commentator. REUTERS/Steve Marcus

- Date: Sep 17, 2022

- Category: Business

- Source: Google

At Least 9 Dead In California Wildfires From Malibu To Paradise

view source- Another resident told Jeremy Siegel of member station KQED that as she attempted to get out of the area, "we were engulfed in flames both sides of the road." She had to turn her vehicle around and head in another direction to escape, but that all the while, it "scared me to death."

- Date: Nov 09, 2018

- Category: Headlines

- Source: Google

Youtube

Myspace

Flickr

Classmates

Jeremy Siegel

view sourceSchools:

Shaarei Torah High School Suffern NY 1987-1991

Community:

Aron From, Yehuda Jacoby, Yerachmiel Garfield, Frank Ricard, H Havisham, Ari Hoffnung

Jeremy Siegel

view sourceSchools:

Monticello Middle School Monticello NY 1999-2003

Community:

Robert Bock, Belinda Lorino, Terence Armstead

Monticello Middle School,...

view sourceGraduates:

Jennifer Jurjevic (1977-1979),

Elizabeth Carol (1968-1971),

Joseph Lavecchia (1998-2000),

Jeremy Siegel (1999-2003),

Kimberley Mcmanus (1982-1985)

Elizabeth Carol (1968-1971),

Joseph Lavecchia (1998-2000),

Jeremy Siegel (1999-2003),

Kimberley Mcmanus (1982-1985)

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view source

Jeremy Siegel

view sourceGet Report for Jeremy Micah Siegel from Colorado Springs, CO, age ~55