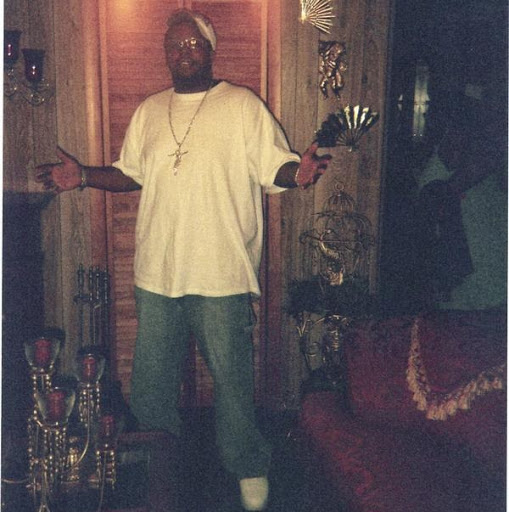

Lloyd H Adams

age ~58

from Columbia, MO

- Also known as:

-

- Lloyd Hamilton Adams

- Lloyd J Adams

- Lloyd D Adams

- Lloy D Adams

- Floyd Adams

- Dawn Adams

Lloyd Adams Phones & Addresses

- Columbia, MO

- 10802 Plainfield St, Houston, TX 77031

- 2107 Corona Dr, Killeen, TX 76549 • 2546347313

- Fort Hood, TX

- Barrington, RI

- 26 Hollywood Dr, Lampasas, TX 76550 • 5125565520

- Wichita, KS

Resumes

Lloyd Adams

view sourceLocation:

United States

Lloyd Adams

view sourceLocation:

United States

Lloyd Adams

view sourceLocation:

United States

Lloyd Adams

view sourceLocation:

United States

Assistant Vice President At Bank Of America

view sourcePosition:

Assistant Vice President at Bank of America

Location:

United States

Work:

Bank of America since Feb 1997

Assistant Vice President

Bank of America Feb 1997 - Aug 2010

Assistant Vice President

Assistant Vice President

Bank of America Feb 1997 - Aug 2010

Assistant Vice President

Education:

Villanova University 2011 - 2011

Lloyd Adams

view sourceLocation:

United States

Military Trainer At Vinnell Arabia

view sourcePosition:

military trainer at Vinnell Arabia

Location:

Columbia, Missouri Area

Industry:

Military

Work:

Vinnell Arabia since Aug 2006

military trainer

U.S ARMY 1986 - 2006

Combat Engineer

US, overseas Apr 1986 - Apr 2006

U.S. Army

military trainer

U.S ARMY 1986 - 2006

Combat Engineer

US, overseas Apr 1986 - Apr 2006

U.S. Army

Skills:

Combat Engineer

equipment operator

Force Protection

Military

Army

Operational Planning

DoD

Military Operations

Equal Opportunities

Personnel Security

Equipment Maintenance

DoD Top Secret Clearance

Weapons

Security Clearance

Intelligence

National Security

Contract Management

Physical Security

Military Experience

Counterterrorism

Command

Intelligence Analysis

Counterinsurgency

equipment operator

Force Protection

Military

Army

Operational Planning

DoD

Military Operations

Equal Opportunities

Personnel Security

Equipment Maintenance

DoD Top Secret Clearance

Weapons

Security Clearance

Intelligence

National Security

Contract Management

Physical Security

Military Experience

Counterterrorism

Command

Intelligence Analysis

Counterinsurgency

License Records

Lloyd D. Adams Jr.

License #:

MA.001703 - Active

Issued Date:

Dec 13, 2011

Expiration Date:

Aug 31, 2017

Type:

Medication Administration (V)

Lloyd D. Adams Jr.

License #:

PIC.014855 - Active

Issued Date:

Mar 27, 1991

Expiration Date:

Dec 31, 2017

Type:

Pharmacist-in-Charge (V)

Lloyd D. Adams Jr.

License #:

PST.014855 - Active

Issued Date:

Mar 27, 1991

Expiration Date:

Dec 31, 2017

Type:

Pharmacist

Isbn (Books And Publications)

Wetlands Overview: Problems With Acreage Data Persist

view sourceAuthor

Lloyd L. Adams

ISBN #

0788179772

Name / Title

Company / Classification

Phones & Addresses

Partner

Bristol Harbor Inn

Hotel/Motel Operation · Bed-&-Breakfast Inns

Hotel/Motel Operation · Bed-&-Breakfast Inns

259 Thames St, Bristol, RI 02809

4012541444, 4012541333

4012541444, 4012541333

Managing

QC4QC, LLC

President, Director, Secretary, Treasurer

BE WELL INC

Misc Personal Services

Misc Personal Services

Po B 667221, Houston, TX 77266

Director, Secretary

RIVER OAKS COUNCIL OF CO-OWNERS

1800 Augusta Dr STE 200, Houston, TX 77057

Miles Ave. Property Co., LLC

Real Estate · Nonresidential Building Operator

Real Estate · Nonresidential Building Operator

474 Hope St, Bristol, RI 02809

4012532016

4012532016

HANDS ON HEALTH

Massage Therapy

Massage Therapy

1712 Fairview, Houston, TX 77006

7133558128

7133558128

Director

East Bay Chamber Of Commerce

Management Consulting · Provide Services To The Business Community · Civic Organization · Business Associations

Management Consulting · Provide Services To The Business Community · Civic Organization · Business Associations

16 Cutler St #102, Warren, RI 02885

4012450750, 4012450110

4012450750, 4012450110

SOUTHSIDE BAPTIST CHURCH

Us Patents

-

Peer-To-Peer Hosting Of Intelligent Field Devices

view source -

US Patent:6978294, Dec 20, 2005

-

Filed:Mar 20, 2000

-

Appl. No.:09/531597

-

Inventors:Lloyd B. Adams - Bristol RI, US

Alexander P. Johnson - Houston TX, US -

Assignee:Invensys Systems, Inc. - Foxboro MA

-

International Classification:G06F015/16

G06F015/173 -

US Classification:709217, 709221, 709222, 709223, 709224, 709225, 709226

-

Abstract:Device configurations are stored in a system including at least two intelligent field devices (IFDs) connected by a communications connection. A configuration for a first IFD is stored in the first IFD, and a backup of the configuration for the first IFD is stored in at least one other IFD. Storing a configuration for the first IFD may include having the first IFD request a configuration from at least one other IFD using the communications connection, an IFD having a stored backup of the configuration for the first IFD transmitting the backup to the first IFD using the communications connection, and the first IFD receiving the transmitted backup and storing the received backup in the first IFD as the configuration for the first IFD. Storing a backup of the configuration for the first IFD may include having the first IFD transmit a backup of the configuration for the first IFD to at least one other IFD using the communications connection, and having the at least one other IFD receive and store the backup of the configuration.

-

Network Based Financial Transaction Processing System

view source -

US Patent:7389256, Jun 17, 2008

-

Filed:Aug 2, 1999

-

Appl. No.:09/366135

-

Inventors:Lloyd A. Adams - Houston TX, US

Hani Yakan - Houston TX, US -

Assignee:JPMorgan Chase Bank, N.A. - New York NY

-

International Classification:G06Q 40/00

-

US Classification:705 35, 705 27, 705 26, 705 40

-

Abstract:A system and method for processing financial payments including a user terminal, an account processor, and a processing server. The processing server receives financial transaction data from the user terminal and communicates with the account processor, the financial transaction data comprising an amount and an account number. The processing server determines which of the account processors corresponds to the financial transaction data and transmits at least part of the financial transaction data to the determined account processor.

-

Peer-To-Peer Hosting Of Intelligent Field Devices

view source -

US Patent:7610354, Oct 27, 2009

-

Filed:Aug 22, 2005

-

Appl. No.:11/207816

-

Inventors:Lloyd B. Adams - Bristol RI, US

Alexander P. Johnson - Houston TX, US -

Assignee:Invensys Systems, Inc. - Foxboro MA

-

International Classification:G06F 15/16

G06F 15/173 -

US Classification:709217, 709220, 709221, 709222, 709223, 709224, 709225, 709226

-

Abstract:Device configurations are stored in a system including at least two intelligent field devices (IFDs) connected by a communications connection. A configuration for a first IFD is stored in the first IFD, and a backup of the configuration for the first IFD is stored in at least one other IFD. Storing a configuration for the first IFD may include having the first IFD request a configuration from at least one other IFD using the communications connection, an IFD having a stored backup of the configuration for the first IFD transmitting the backup to the first IFD using the communications connection, and the first IFD receiving the transmitted backup and storing the received backup in the first IFD as the configuration for the first IFD. Storing a backup of the configuration for the first IFD may include having the first IFD transmit a backup of the configuration for the first IFD to at least one other IFD using the communications connection, and having the at least one other IFD receive and store the backup of the configuration.

-

Network Based Loan Approval And Document Origination System

view source -

US Patent:20010032178, Oct 18, 2001

-

Filed:Jan 18, 2001

-

Appl. No.:09/765137

-

Inventors:Lloyd Adams - Houston TX, US

Merlin Reynolds - Houston TX, US -

International Classification:G06F017/60

-

US Classification:705/038000, 705/035000, 705/039000, 705/042000

-

Abstract:A customer sends loan information through the Internet to a loan approval system mainframe of a bank. The information is entered into a blank load form displayed on a web site hosted by the loan approval system computer. The loan approval system mainframe produces a loan application and sends the loan application to a credit bureau. The credit bureau determines whether the customer should receive the loan. If the customer is to receive the loan, the loan approval system computer sends the loan application to a loan document creation server coupled to a forms database. The loan document creation server sends the appropriate loan documents and/or check to the customer either physically or electronically. In one embodiment, acceptance of the terms of the loan in the loan documents occurs when the customer cashes the check.

Plaxo

Lloyd Bryan Adams

view sourceIncline Village, NV

Lloyd Adams

view sourceOwner at Bristol Harbor Inn

LLoyd Adams

view sourceSydney

Classmates

Lloyd Adams

view sourceSchools:

Johns Creek High School Pikeville KY 1981-1985

Community:

Sandra Edwards, Joann Coleman

Lloyd Adams

view sourceSchools:

Coldwater High School Coldwater MI 1975-1979

Community:

John Allen, Tracy Maggart

Lloyd Adams

view sourceSchools:

Jenkins High School Savannah GA 1965-1969

Community:

Irene Bates, Allen Stroth, Ulric Tony

Lloyd Adams

view sourceSchools:

Nansemond-Suffolk Academy Suffolk VA 1970-1974

Community:

Laura Cherry

Lloyd Adams

view sourceSchools:

Monsignor Bonner High School Drexel Hill PA 1960-1964

Community:

Linda Tynan, Denise Murter, Paul Lorentz, Joseph Nager, Tom Burke

Westdale High School, Ham...

view sourceGraduates:

Lloyd Adams (1975-1979),

Kim Maguire (1991-1995),

Jim Fletcher (1974-1978),

Stephen Veldhoen (1990-1994),

Leslie Solomon (1962-1966)

Kim Maguire (1991-1995),

Jim Fletcher (1974-1978),

Stephen Veldhoen (1990-1994),

Leslie Solomon (1962-1966)

Crane Junior College, Chi...

view sourceGraduates:

Lloyd Adams (1978-1982),

Anthony Wasilewski (1942-1946),

Andrew Prestwood (1967-1968),

William Copeland (1956-1960)

Anthony Wasilewski (1942-1946),

Andrew Prestwood (1967-1968),

William Copeland (1956-1960)

Bear River Junior High Sc...

view sourceGraduates:

Elizabeth Waldron (1940-1944),

Lloyd Adams (1960-1964),

May Dawn Chapman (1975-1979),

Heather Dworshak (1999-2003),

Kaleb McClellan (1998-2002)

Lloyd Adams (1960-1964),

May Dawn Chapman (1975-1979),

Heather Dworshak (1999-2003),

Kaleb McClellan (1998-2002)

Youtube

Myspace

Lloyd Adams

view sourceGoogleplus

Lloyd Adams

Work:

Ret;d

Education:

Bloominton,in. hs

Lloyd Adams

Lloyd Adams

Lloyd Adams

Lloyd Adams

Lloyd Adams

Lloyd Adams

Lloyd Adams

Lloyd Adams

view source

Lloyd Stone Adams

view source

Lloyd William Adams

view source

Chris Lloyd Adams

view source

Lloyd Adams

view source

Lloyd Adams

view source

Lloyd Adams

view source

Lloyd Adams

view sourceFlickr

Get Report for Lloyd H Adams from Columbia, MO, age ~58