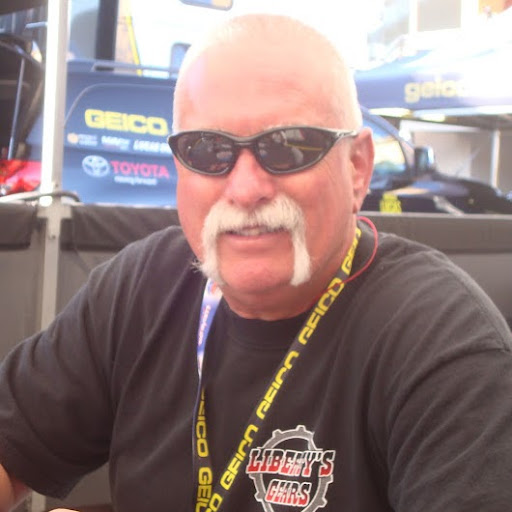

Larry G Elliott

age ~56

from Tucson, AZ

- Also known as:

-

- Larry Gene Elliott

- Larry G Elliot

- Nancy Acosta-Gomez

Larry Elliott Phones & Addresses

- Tucson, AZ

- 824 Wintersweet Rd, Henderson, NV 89015 • 9286490149

- Victorville, CA

- Needles, CA

Work

-

Company:Dentons Cohen & Grigsby P.C.

-

Address:

Specialities

Litigation

Wikipedia References

Larry Elliott

Work:

Position:

British journalist • The Guardian journalist • Author

Education:

Studied at:

St Albans School, Hertfordshire

Skills & Activities:

Preference:

Independent

Larry Elliott

Lawyers & Attorneys

Larry Elliott - Lawyer

view sourceOffice:

Dentons Cohen & Grigsby P.C.

Specialties:

Litigation

ISLN:

907616526

Admitted:

1981

University:

University of Virginia, B.A., 1974; University of Virginia, M.A., 1977

Law School:

College of William & Mary, J.D., 1981

Name / Title

Company / Classification

Phones & Addresses

President

THE POTTER'S CHRISTIAN AND MISSIONARY FELLOWSHIP, INC

8449 E Ruby Dr, Tucson, AZ 85730

M

Reliant Construction, LLC

Building Equipment Installation Plumbing/Heating/Air Cond Contractor

Building Equipment Installation Plumbing/Heating/Air Cond Contractor

2919 Galena Dr, Henderson, NV 89074

7025236457, 7025955525

7025236457, 7025955525

LCE PROPERTIES LLC

FAMILY RENTALS OF S P INC

FAMILY SENIOR CARE, INC

EZ UP LIFT SYSTEM LP

OBSERVATION SERVICES, INC

GREEN ACRES LAWN & LANDSCAPE, INC

Youtube

News

Labour mustn't wait. It should unite to make the most of Tory disarray

view source- Larry Elliotts call to sit back and watch events unfold (Let the Tories clear up their own mess, 12 June) would not only be a dereliction of duty by Her Majestys official opposition to remove the Tories from office, but seriously underestimates the Conservatives resolve to regroup, reunite an

- Date: Jun 12, 2017

- Source: Google

Bank of England Governor Mark Carney News Conference (Text)

view source- QUESTION: Larry Elliott of the Guardian. Can you tell uswhat statistical relationship there is between unemployment andinflation in the U.K.? In the U.S., they use this sort ofthreshold, unemployment threshold, but there is quite a stablerelationship between the level of unemployment and the

- Date: Aug 07, 2013

- Category: Business

- Source: Google

Britain's economy returns to growth in first quarter – live

view source- But with the UK still 2.6% smaller than at its peak in 2008, there's no reason to rejoice (see Larry Elliott's analysis). Britain's recovery from the shock of the financial crisis remains slower than in the 1930s (see graph here).

- Date: Apr 25, 2013

- Source: Google

PPI mis-selling charge reaches £5.3bn at Lloyds

view source- Check this out from the ever interesting Golem XIV (David Malone). It tries to answer the very question you posed. Also worth reading is Hawkeye's response. Now his response is something I would like to be further analysed by Larry Elliott and others at The Guardian.

- Date: Nov 03, 2012

- Category: Business

- Source: Google

Eurozone crisis live: Fresh speculation over Greece's future

view source- Certainly that is my impression of the editorial line of the Guardian. Hard to think otherwise when Larry Elliott writes (recently) the Euro should be smashed to pieces. As if this boneheaded action would start a new dawn of economic growth.

- Date: Oct 15, 2012

- Category: Business

- Source: Google

OECD downgrades growth forecasts and calls for more stimulus

view source- A eurozone that somehow stays afloat but can't be reformed, banks awash with cash that don't lend, and incoherent economic policy. We've only found a sticking-plaster solution to our crisis, writes Larry Elliott

- Date: Sep 06, 2012

- Source: Google

No easy solutions for Greece and the euro

view source- Your economics editor, Larry Elliott, (The flawed euro is ripe for creative destruction, 21 May) rightly notes that Ireland and Spain suffer from having accepted too much private debt. Then he blames this on low interest rates set by central banks. He must know the rates at which individuals, busi

- Date: May 21, 2012

- Category: World

- Source: Google

Eurozone crisis: Markets to post hefty losses for 2011

view source- Yields move in inverse proportion to the price of a bond, so low yields indicate that investors are placing a high premium on UK debt (although the rush into safer government bonds also reflects fears of sluggish economic growth, as Larry Elliott explains here).

- Date: Dec 30, 2011

- Category: Business

- Source: Google

Plaxo

Larry Elliott

view sourceRetired Retired Principal of a High School in Indiana.

Larry Elliott

view sourceAuckland, New Zealand

Larry Elliott

view source

Larry Elliott

view sourceVienna, VirginiaLeadership Asssessment and Development Consulting. After completing more than 40 current cases on leadership assessment for top leaderes of global companies I... Leadership Asssessment and Development Consulting. After completing more than 40 current cases on leadership assessment for top leaderes of global companies I am beginning a newe book, Real Leaders, in association with Greg Selker of Selker Leadership.

As CEO of EDA, Inc. I continue my work as an...

Larry Elliott

view sourceFlint, MichiganOwner at 1099

Larry Elliott

view sourceOwner at fipentertainment

Googleplus

Larry Elliott

Work:

FotoPhox .com - Owner/ artist (2010)

USAF, - Lt Col (1958-1978)

Real Estate Center - Broker/ Owner (1979-2000)

USAF, - Lt Col (1958-1978)

Real Estate Center - Broker/ Owner (1979-2000)

Education:

Scarsdale.NY HS, Dartmouth College - Liberal arts, U. Nebr, Omaha - Poly sci

Relationship:

Married

Tagline:

Three careers wasn't enough. Started my fourth at age73

Bragging Rights:

Retired Musician, Air Force Officer, Real Estate broker

Larry Elliott

Work:

Retired

Education:

Indiana University - Social Studies, Owensboro

Tagline:

Retired High School Administrator

Bragging Rights:

Have 1 daughter and 2 Grand Children

Larry Elliott

Larry Elliott

Larry Elliott

Larry Elliott

Larry Elliott

Larry Elliott

Get Report for Larry G Elliott from Tucson, AZ, age ~56